Preface:

Back when I was a heads down developer analyst working at General Motors, my mindset was completely focused on being a data expert and techie. At the time I did not have a broader understanding of business concepts and business strategies. Thus, I considered myself a “one dimensional” resource (a very competent one dimensional resource but one dimensional nonetheless). I set out to remedy my blind spots by acquiring business knowledge so I would have an understanding of broader concepts, become less myopic, and position myself favorably in the marketplace against other one dimensional techies (like myself at that time).

Subsequently, it was in business school where I first learned of American academic Dr. Michael E. Porter of Harvard Business School fame. Mr. Porter is regarded as the preeminent thought leader in the area of business strategy and competitiveness.

Generic Competitive Strategies:

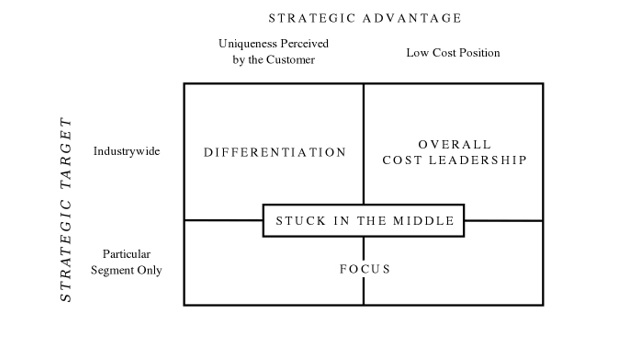

I found value in studying and discussing Porter’s framework that defined generic competitive strategies. A generic competitive strategy is a business level strategy that companies adopt in order to obtain a competitive advantage. The strategies are termed generic because they can be pursued by any and every company across a range of industries. The three primary strategies employed in the framework are:

• Cost Leadership (low cost structure, e.g. Wal-Mart, Dell, Southwest Airlines)

• Differentiation (offering unique product and services for a premium, e.g. Apple, BMW, Starbucks)

• Focus (limiting scope to narrow market segments, e.g. local restaurant or local service provider)

These three strategies help contextualize how businesses aim to obtain profits in their respective marketplaces; they also help businesses understand how they can seek new opportunities for advantage. Porter originally emphasized that a company should target only one of the strategies in the framework or risk paying a “straddling penalty” (a la the doomed airline offshoot Continental Lite). Porter later softened his stance in this regard recognizing the benefits of a hybrid approach in some cases.

Cost Leadership Strategy:

This post focuses on cost leadership because it’s the strategy that relates tangentially to IT and the concept of globalization. As IT workers are aware, the forces of globalization have no mercy in their enablement of companies to offshore work in an attempt to lower costs. This outsourcing of IT work to offshore firms is happening at organizations such as Disney, the University of California and [Insert Any Bank Name Here]. Obviously not all technology related offshoring is done in order to focus on a cost leadership strategy but the activity’s initial intent is to lower a firm’s IT cost structure (refer to my post on how IT has to do a better job communicating its value).

Returning to the main point, the cost leadership strategy is employed when a company aims to be the lowest cost producer in the market. Strategic managers in the organization make a concerted effort to lower business costs in order to achieve a competitive advantage. A lower cost structure enables a business to reap higher than average profitability.

Businesses attempting to implement this strategy may aim to increase inventory turnover, lower their wage expenses and/or manufacturing costs, gain bargaining power over suppliers, develop distinctive competencies in logistics, develop low cost distribution channels or any combination thereof. As an aside, I could prattle on ad-nauseam about Wal-Mart and how its technological capabilities provided the organization significant advantages (and I have here: Part 1, Part 2 and Part 3).

Advantages:

When the cost leader and another company decide to compete in the same price range for the same customers, the cost leader will have the inherent advantage because it will reap higher profits due to its lower cost structure. The cost leader will be able to weather the “price war” due to its lower cost structure advantage.

“The cost leader chooses a low to moderate level of product differentiation relative to its competitors. Differentiation is expensive; the more a company expends resources to make its products distinct, the more its costs rise. The cost leader aims for a level of differentiation obtainable at a low cost. Wal-Mart, for example does not spend hundreds of millions of dollars on store design to create an attractive shopping experience as chains like Macy’s, Dillard’s, or Saks Fifth Avenue have done.” [1]

The cost leader also positions its products to appeal to the “average customer”. The aim is to provide the least number of products desired by the highest number of customers. Although customers may not find exactly what they are seeking, they are attracted to the lower prices [1].

Disadvantages:

Since the strategy involves providing the lowest costs, companies must strive for a large market share when employing this strategy. The cost leadership strategy has been linked to lower customer brand loyalty which in turn means that customers can be swayed by lower priced substitutes from other competitors.

Additionally, as technological change enters the marketplace, new competitors can attack cost leaders through innovation thus nullifying the cost leader’s accumulated advantages. For example, Amazon has accumulated substantial knowledge and proficiencies in the online e-tail space and has placed Wal-Mart on the defensive in this arena as Wal-Mart’s expertise is tailored to its brick and mortar assets.

Or as foretold in Porter-speak back in his 1996 HBR article “What is Strategy”,

“A company may have to change its strategy if there are major structural changes in its industry. In fact, new strategic positions often arise because of industry changes and new entrants unencumbered by history often can exploit them more easily.” [2]

References:

[1] Hill, Charles. W. L., & Jones, Gareth. R. (2007). Strategic Management Theory. Houghton Mifflin Company

[2] Porter, M. E. “What Is Strategy?” Harvard Business Review 74, no. 6 (November–December 1996): 61–78.

Header Image Copyright: olivier26 / 123RF Stock Photo</a>

Diagram Image By Denis Fadeev – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=32434551